Medical Accounts Receivables Audit Companies can provide Eye-Opening Information

How do you determine whether or not the amount of receivables owed to you by insurance companies and patients, is satisfactory? In the Medical Billing World, how do we define ‘Satisfactory’ anyway? What we suggest is, have an experienced company perform an audit of your receivables and evaluate what is tolerable, to ‘you’, and not what is tolerable to ‘the industry’. What is tolerable to a Physical Therapist, may not be so, to a Cardiologist. If you do decide to have an audit performed, here are 5 things you should learn from Medical Accounts Receivable Audit Companies, when they perform an evaluation on your receivables:

#1 Aging under 90 days old should be no less than 85% of the total

Insurance Balances other than Workers Compensation balances, under the age of 90 days from the Date or Service, should be no less than 85% of your total AR. Its important to note, the aging must be reflected from the Date of Service, not date of last billed. Date of Service is not able to be altered, claims however, can be re-billed creating a new; ‘date of last billed” date, therefore skewing your aging. Aging from the Date of Service is fixed; the patient was there on that day, and received these procedures. There is no arguing this.

#2 At Least, 40% of your Blue Cross Patient Balance, should be less than 90 days old.

These are your most collectible patient balances, assuming you’ve determined the balance they owe is in fact, patient responsibility. Blue Cross Patients are in many cases employed, typically have a higher credit score, and pay their bills from a first or second statement. These are the patients who are most like you and me, we pay our bills…. So, if you’ve determined this is a balance they owe, and have sent a statement to the correct address, then no less than 40% of this group should pay you in the first 90 days.

#3 How do your reimbursements compare to other ‘Like Providers”?

If you’ve hired a Medical Accounts Receivable Audit Company to perform an audit, they should have the experience to be able to educate you on “What the average Pediatrician reimbursement is from Blue Cross when a 99213 is performed in St. Louis”. They should tell you what a Nurse Practitioner should receive from Cigna in West Tennessee when a 99214 is used with a 59 modifier. This is the best way to get a feel for what your potential is.

#4 How Quickly is your medical practice getting reimbursed?

Turnaround is key, and the best evaluator of how quickly you’re getting paid is by calculating your Days in AR. Steve, over at Accounting Tools, has a great post on the importance of Days in AR and best of all, how to calculate it. The most important metric here is how quickly are your claims being paid from the date of service, not the date of billing. Why not the Date of Billing? Because this date can be altered, A date of service cannot. The patient was there on that day, received this procedure, and this should not change. And, keep in mind, If you’re like a lot of practices who bill on a weekly basis, rather than daily, your days of AR are potentially 7 days inaccurate. If you’re billing less often than than weekly…Well, you get the drift!

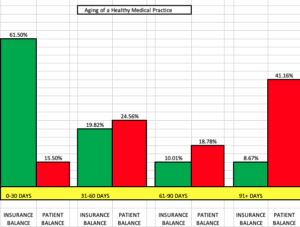

#5 What does ‘Healthy Aging’ in a Medical Practice?

Healthy Aging means different things to different providers. If your patient demographics are heavily Blue Cross Blue Shield, then you expect a great portion of your Insurance claims to be paid in under 20 days. If you’re heavily Workers Compensation, then 20 days is most certainly out of the question. Below is a visual chart of what healthy aging looks like. This is assuming you are diligent at writing off aged patient balances to collections in a timely manner.

If you would like more ways to analyze the efficiency of your practice, check out this post from Physicains Practice which offers more benchmarks you should monitor monthly: Let us know if we can help you analyze your aging, and best of all…. Offer Solutions.