Let’s take a deep dive into your Medical Practice Aging.

We get a lot of questions from prospects concerned about their Medical Practices- Insurance Aging. There seems to be a misconception regarding their aging about, how much of it is “real revenue” and can actually improve your financial status in the world, and how much is; well just ‘fluff’.

Your Medical Practice Aging is the amount owed to you, after you’ve billed out your charges. Seems pretty easy to understand; that is until the healthcare industry complicates it for us. For most businesses, the total aging represents an amount that is 100% collectable. However, unless you’re looking at your Total Patient Aging, your Insurance Aging will reveal numbers where you can only collect a fraction of the amount listed.

You see, Medical Insurance is a whole different animal.

Your Total Medical Practice Insurance Aging will represent 3 different variables;

The Charge, The Adjustment, and The Payment. Because of these 3 variables your aging appears inflated, compared to that of say; a restaurant.

The Procedure Code Charge

Whether you charge $150 for a 99213 or $175 for a 99214, this entire amount will reside on your aging. It’s true, the moment you press the ‘send’ button to batch the claim to the clearinghouse, your Aged Trial Balance is updated to reflect this new procedure and it’s associated price.

The Contractual Adjustment

After your charge, then comes the Contractual Adjustment. This is the amount the insurance company takes, or ‘omits’ from payment when they reimburse you for the procedure you rendered. This amount is what you agreed to when you signed up to be in the Insurance companies Network of Providers. Remember that fine print on the application?

The Payment

The whole reason we work, right? Ok, maybe the second reason, the first being; improving the health of your patients.

The payment is, the amount left over after the Contractual Adjustment was so swiftly withdrawn out of the Procedure Code Charge. The payment, that’s the “Real Money” and would be considered the amount you can use to improve your personal living standards.

The confusion and anxiety overcomes providers when they look at their total insurance aging and, as an instinctive reaction to the amount listed, their pores open to release copious amounts of perspiration. But, hang on, hang on, let me talk you off the ledge.

The amount you’re looking at, includes the Payment and the Adjustment. So, in reality, you’re looking at a number where only a percentage, would actually be able to assist in increasing your living standards. That is, until banks start taking ‘contractual adjustments’ in lieu of cash as a means of paying down a mortgage loan. A day I’m sure you’re eagerly awaiting!

So, in an effort to assist you in avoiding heart palpitations as you scan your aging, keep in mind this is an inflated amount. And, keep in mind, the “0-30” or the “Current” category may include a procedure you billed out an hour ago.

But most of all, your Aging is a living, breathing, organism. It’s like a child; it grows while you sleep, it requires constant attention, and if left un-attended; heck, it’s libel to burn the house down. Every time you post a payment or an adjustment, your overall aging shrinks, and every time you post a charge and bill the insurance your aging grows.

So, I have a considerable amount owed to me, what is the industry standard for a Medical Practices Aging?

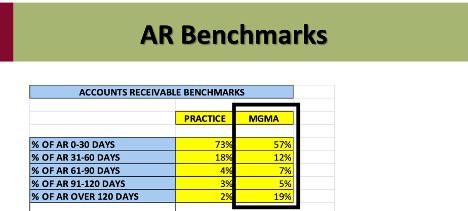

Here is what the MGMA recommends as an ideal Benchmark for Aging.

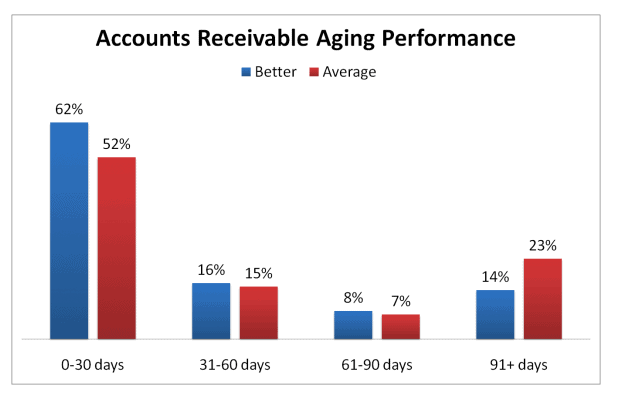

While, a collection agency I’m familiar with says; this is what a healthy Accounts Receivable should look like:

After investigating the 0-30 buckets, you can see they vary by 5%. So, if we were to put this into context; if the total aging was $1,000,000 and there is a 5% difference between the 57% the MGMA recommends to have in ‘Current” and the 62% the Collection Agency recommends to have, that 5% alone represents a staggering $50,000!

Here is why I’m not a fan of “Benchmarks” when it refers to your Medical Practices Aging.

Subjectivity

Bench-marks assume all adjustments are created equal, when they are not.

An urgent care practice in downtown St. Louis may charge Blue Cross Blue Shield $160 for a 99213, whereas a similar urgent care in the suburbs charges $140. Blue Cross’ reimbursement contract for both locations may be the exact same by reimbursing $100 after adjustment. But that means the Downtown Location will have a 37.50% adjustment, and the suburbs location would have a 28.57% adjustment.

In the end, the Suburbs location and the Downtown location would show different amounts on their age trial balance for this encounter. What’s more, the reimbursement rate for the Downtown location when the claim paid, would yield a 62.50% reimbursement rate, verses a 71.43% reimbursement rate for the Suburbs location.

So, in the end, It really comes down to how you set your Fee Schedule. If you know Blue Cross’ reimbursement for a 99213 will be $100, you likely want to charge $120 or $150 to potentially cover the random Iron Workers Union Policy, that may pay $115.

The best way to set your fee schedule pricing is to set each procedure codes price to be 120-150% of what Medicare would reimburse. This way you’re covered for those outlier insurance payers who happen to pay a higher rate than Medicare. There aren’t many so don’t get your hopes up!

It’s also very important that you review your pricing at least on an annual basis. If you find any insurance company who is reimbursing a procedure at 100%, it’s time to raise the price on that procedure. If you need help with your fee schedule, we offer Fee Schedule Review Service, and would be glad to help get you on the path to prosperity.